Embrace the risk as inflation and markets move.

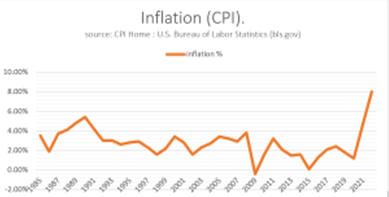

There is a lot of talk about the economy and the markets in the news currently and many people are uneasy about the current state of the economy. Markets are down year to date and prices of many everyday goods are rising rapidly (see inflation chart below that shows inflation since 1985). On top of that we have a rising interest rate environment that create issues around buying or selling real estate. If you are anxious about what is taking place in the stock market and feel like you should make changes to your portfolio, then you may need to find a better way to invest. This is not about predicting future guaranteed superior returns and if anyone promises that you may want to reconsider their plan and move on. This is about how you need to have a portfolio that is built around facts that support the composition of the portfolio with academic tested principles supporting the lineup.

If there was no risk in owning a stock portfolio you would not be able to expect positive returns that combat and exceed inflation over time. The risk/volatility that comes with owning a portfolio of stocks and bonds is precisely what allows you to expect positive returns over time.

Not all people can handle risk and thereby decide to have their money held in cash and/or

more “conservative” accounts in hope of seeing less volatility and hope to experience a lesser bumpy ride for their invested portfolios. The decision to invest with lesser market risk can be due to prior market experience, risk adverse mindset, age/ time horizon or other factors.

And downturns in the market can be tough to handle for the individual investor. The great depression saw huge downturns, 2001-2002 had declines in most portfolios and 2008 saw immense declines in the equity market. 2022 has also been a tough year for stocks halfway through the year seeing many segments of the market down more than 20%.

Understanding your time horizon is what can allow you to take on risk and having a clear and precise understanding of what the invested money is to be used for.

A 2-year time horizon most likely does not allow you to take on as much risk as someone with a 10- or 20-year time horizon and understanding if you need all the money at once or if you will be spending the money slowly over time will also make quite a difference in deciding how the portfolio should be allocated. Even when you need income from your portfolio within the near future you could still have a long-time horizon for the entire period of when you will be taking income from the portfolio. As an example, a 64-year-old who wants to start income at 66 may feel that he has a 2-year time horizon but his true portfolio most likely needs to stay invested and grow for the next 20 plus years.

It is always important to look at the bigger picture of investing in financial markets. There has been and there will be future downturns in the market, and they can be close to impossible to predict so broadening the time horizon and looking at the market with your expected holding period is critically important.

The chart (S&P500 YTD) is a showing the S&P 500 year to date and looking at a graph like that can be frightening and often keep people away from participation and is also when a lot of individuals as well as advisors start looking for “new” investments that now fit the current market. Shifting in and out of portfolios not only create unnecessary fees, potential additional tax cost and more often does nothing good for the long-term outcomes. According to the 2022 QUAIB Dalbar study the average equity investor has underperformed the S&P 500 over the last 10 years by more than 3% annually and the study indicates that the average investor has a hard time staying invested long enough to realize the benefits of owning assets over time. This indicates that many investors move in and out of portfolios trying to find a better setup and that clearly hurt their investment results.

Before deciding on your portfolio, you should be asking yourself many questions and you should be able to answer them all clearly. Some of the important questions you must ask yourself are: “Why are you investing?” What is your time horizon for this investment?” “Do you know how to measure the risk and volatility in your portfolio and are you comfortable with that risk?” “Is the portfolio lineup built around academics and science?”

You should have a portfolio that can be shown to work in all economic situations and a portfolio that ought not to be changed and modified just because of new political or economic situations develops.

Portfolios should be built to last and should be working for your specific time horizon and your specific goals (e.g., long term growth, retirement income, college planning)

Reduce stress around your portfolio by understanding:

- How an academically empirically tested portfolio is built

- Understand a portfolios specific volatility (measured)

- Diversification: what is means and how to analyze the effect

- What are premium returns and do they exist in the market

- Expected returns based on factor exposure

Guardian, its subsidiaries, agents and employees do not provide tax, legal, or accounting advice. Consult your tax, legal, or accounting professional regarding your individual situation.

Past performance is not a guarantee of future results. I.ndices are unmanaged and one cannot invest directly in an index. All investments contain risk and may lose value. Equities may decline in value due to both real and perceived general market, economic and industry conditions