Over the past few years, we’ve witnessed a notable hike in interest rates, coupled with an uptick in inflation and the cost of living. These shifts can understandably raise questions and concerns about the stability and performance of your investment portfolio.

Academic structured portfolios are meticulously crafted to weather various market conditions while aiming for long-term growth and stability. By diversifying across asset classes and adhering to time tested academic principles, these portfolios are designed to mitigate risks and capitalize on opportunities in the global market. Coupled with true diversification and ongoing rebalancing , these portfolios are well set up for any economic or political turbulence.

In times like these, when uncertainty looms large, having a well-structured investment strategy is paramount. It provides a solid foundation to withstand market volatilities and pursue your financial goals with confidence.

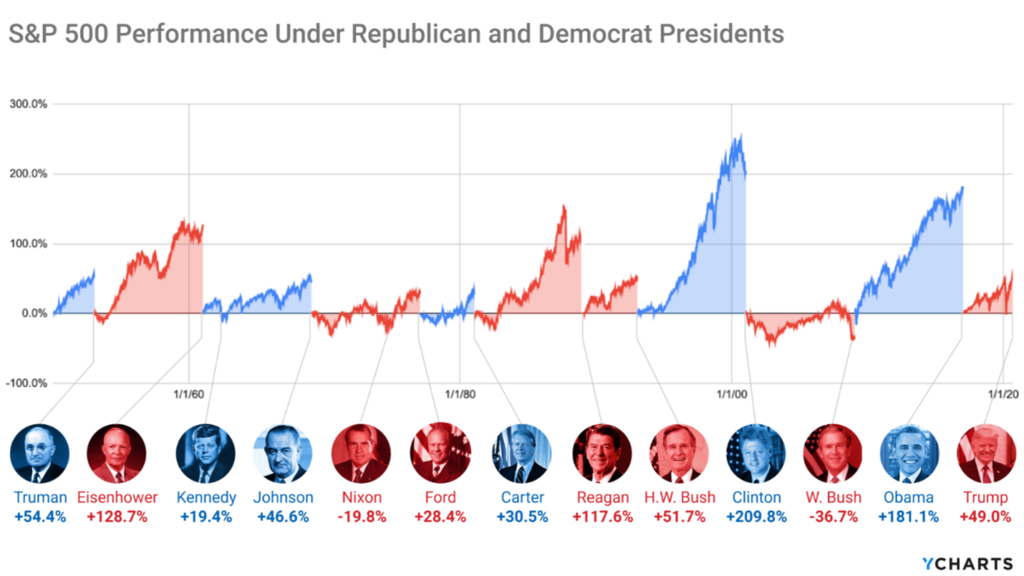

One example of where investors often panic and make irrational decisions is around politics and which party or president is in office.

Identifying systematic return patterns in election years poses a challenge and historical data shows that, on average, market returns have been positive in both election years and the following year. This suggests that market expectations related to election outcomes are typically already reflected in security prices.

In the grand scheme, letting the political landscape dictate portfolio decisions is unlikely to yield positive long-term outcomes. Despite the divisive nature of current economic conditions, investors who remain committed to a long-term strategy have historically reaped rewards.

Past performance is not a guarantee of future results. All investments contain risk and may lose value. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit and inflation risk. Equities may decline in value due to both real and perceived general market, economic and industry conditions. Diversification and rebalancing do not guarantee profit or protect against market loss.