We always strive to use facts and academics when we set up portfolios and, when we as a financial advisor practice, complete advanced financial plans we want our clients to be as knowledgeable as

possible.

This short article explores the limitations of the Fed’s control over interest rates,

particularly long-term rates, as explored by economist Eugene Fama. The relationship between

the Federal Reserve, interest rates, and the market is intricate and constantly evolving.

Fama’s Challenge: Limited Control, Market Influence

Fama argues that the Fed’s ability to dictate interest rates, especially long-term ones, is weaker

than commonly believed. He highlights how market expectations often anticipate the Fed’s

actions, suggesting the market itself plays a significant role in setting these rates. Additionally,

tools like quantitative easing (QE), where the Fed pays interest on reserves to control short-term

rates, further illustrate how the Fed might be responding to market pressures, particularly when

rates are rising. This raises questions about the Fed’s true influence on inflation control and how

effectively short-term rates translate to consumer and business decisions.

Beyond Absolute Control: The Fed’s Role

While the Fed doesn’t have absolute control, its monetary policy actions do impact interest

rates. However, this influence is temporary and intertwined with various factors. Market

expectations, the overall economic climate, and the type of interest rate (nominal vs. real) all

play a part. Determining the true strength of this influence can be challenging due to the

complexities of analyzing historical data and real-world scenarios.

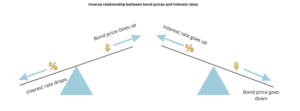

The Market’s Voice: The Bond Market Connection

The bond market offers a clear example of how market forces impact interest rates. Interest

rates and bond prices have an inverse relationship. When interest rates rise, existing bonds with

lower fixed rates become less attractive, causing their prices to fall. Essentially, investors seek

the higher returns offered by newer bonds with more competitive rates.

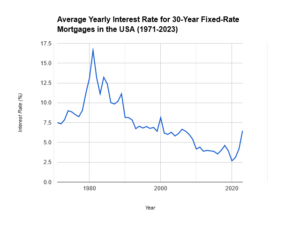

Historical Fluctuations: The Case of Mortgage Rates

Mortgage rates in the USA serve as a historical illustration of this dynamic interplay. Rates have

fluctuated significantly, reaching lows of around 3% in 2021 and highs of nearly 18.6% in 1981.*

While there’s a general downward trend, periods of economic instability can cause spikes,

demonstrating how broader market forces can influence mortgage rates, a crucial factor in the

housing market.

https://themortgagereports.com/61853/30-year-mortgage-rates-chart

Conclusion: A Shared Stage

In conclusion, the Fed plays a role in influencing interest rates, but its control is not absolute.

Market expectations and forces significantly impact both short-term and long-term rates.

Understanding this complex dance between the Fed and the market is essential for navigating

the ever-changing world of interest rates.

If you have a portfolio that you want analyzed please feel free to reach out to our financial advisor team

Sources: Does the Fed Control Interest Rates? The Review of Asset Pricing Studies, Forthcoming Chicago Booth Research Paper No. 12-23 Fama-Miller Working Paper Freddiemac.com *https://themortgagereports.com/61853/30-year-mortgage-rates-chart

Guardian, its subsidiaries, agents and employees do not provide tax, legal, or accounting advice. Consult your tax, legal, or accounting professional regarding your individual situation.

Past performance is not a guarantee of future results. Indices are unmanaged and one cannot invest directly in an index. All investments contain risk and may lose value. Equities may decline in value due to both real and perceived general market, economic and industry conditions. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit and inflation risk. Guardian and its subsidiaries do not issue or advise with regard to mortgages.