In the world of investing, where market fluctuations are the norm, maintaining a correctly balanced investment portfolio is paramount. While selecting the right mix of assets is crucial, equally important is the practice of portfolio rebalancing. Rebalancing involves periodically adjusting the portfolio’s asset allocation to align with the investor’s original intentions. Unfortunately, the importance of portfolio rebalancing is often under-communicated by advisors. In this discussion, we will explore how proper rebalancing restores portfolios to their intended allocations, facilitates buying low and selling high, and enhances risk management.

Restoring Intended Allocation

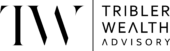

One of the primary objectives of portfolio rebalancing is to restore the portfolio to its intended allocation. Over time, market fluctuations can cause the weights of different asset classes to drift away from their initial targets. For example, during a bull market, equities may outperform other asset classes, leading to an overweighting in stocks. Conversely, during a downturn, bonds or cash equivalents may perform better, causing the portfolio to deviate from its original allocation. By rebalancing, investors realign their portfolios with their desired asset allocation, ensuring that risk exposure remains consistent with their investment objectives and risk tolerance.

Buying Low and Selling High

Portfolio rebalancing presents investors with the opportunity to buy low and sell high, a fundamental principle of successful investing. When rebalancing, investors sell assets that have appreciated in value and purchase assets that have declined in value. This contrarian approach forces investors to sell high-performing assets, which may have become too large a percentage of the portfolio and buy asset classes that have decreased in value and now represent a smaller portion of the portfolio than initially intended. By systematically buying low and selling high, investors enhance the long-term growth potential of their portfolios and mitigate some of the impact of market volatility on their investment returns.

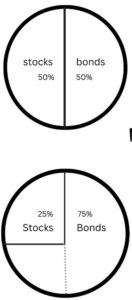

For example, consider an investor comfortable with a portfolio comprised of 50% stocks and 50% bonds. If stock values drop dramatically, shifting the portfolio to 25% stocks and 75% bonds, rebalancing would involve selling some bonds and buying lower-priced stocks, thereby securing the principle of selling high and buying low. This keeps the integrity of the portfolio at the level that the investor initially wanted it to be at.

Risk Management

From a risk management standpoint, portfolio rebalancing is essential for maintaining an appropriate level of risk exposure. Different asset classes exhibit varying levels of risk and performance can be influenced by a multitude of factors, including economic conditions, geopolitical events, and market sentiment. Without regular rebalancing, portfolios may become overly concentrated in high-risk assets during bull markets or overly conservative during bear markets. By rebalancing, investors ensure that risk is spread across a diversified mix of assets, reducing the impact of any single asset’s performance on the overall portfolio.

Psychological Benefits

In addition to its financial implications, portfolio rebalancing offers psychological benefits for investors. Market volatility and fluctuations can evoke emotional responses, leading investors to make impulsive decisions driven by fear or greed. However, adhering to a disciplined rebalancing strategy instills discipline and helps investors stay focused on their long-term investment objectives. By following a predetermined rebalancing schedule, investors can avoid making emotionally driven decisions and maintain a rational approach to investing, ultimately enhancing their financial well-being. We are a financial advisor team in Honolulu and help with the technical as well as emotionally aspect of investing.

Implementation Considerations

When implementing a portfolio rebalancing strategy, several considerations should be addressed. These include determining the frequency of rebalancing, setting tolerance bands for asset allocation deviations, and assessing transaction costs and tax implications. While some investors may opt for periodic rebalancing on a quarterly or annual basis, others may prefer a more dynamic approach based on specific triggers or market conditions. Additionally, tax-efficient rebalancing strategies can help mitigate capital gains taxes and optimize after-tax returns.

Conclusion

In conclusion, portfolio rebalancing is a vital component of sound investment management, ensuring that portfolios remain aligned with investors’ objectives and risk preferences. By restoring portfolios to their intended allocations, facilitating buying low and selling high, and enhancing risk management, rebalancing contributes to the long-term financial health and stability of investors. While the process requires diligence and discipline, the potential benefits in terms of improved risk-adjusted returns and psychological well-being make it a worthwhile endeavor for investors committed to achieving their financial goals.

Guardian, its subsidiaries, agents and employees do not provide tax, legal, or accounting advice. Consult your tax, legal, or accounting professional regarding your individual situation.

Diversification does not guarantee profit or protect against market loss.

Past performance is not a guarantee of future results. All investments contain risk and may lose value. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit and inflation risk. Equities may decline in value due to both real and perceived general market, economic and industry conditions. Diversification and rebalancing do not guarantee profit or protect against market loss.